Toll roads

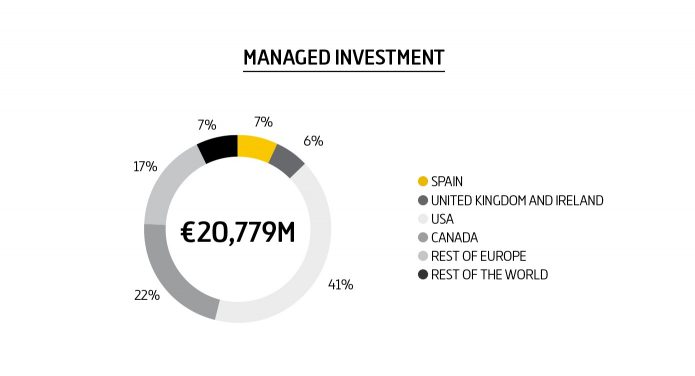

Cintra is a world leader in the private development of transport infrastructure, both in terms of number of projects and the volume of investment. It has 20,779 M€ in total managed investment, with technologically innovative projects and high quality standards.

-

Concessions

27 Assets in 10 countries -

Kilometers

1,894 -

Dividends

290 M€ 27% of total flow (excl.infra.)

BACKGROUND

Cintra has developed its business against a background of high global demand for new infrastructures, including those that resolve the problems of traffic congestion resulting from the concentration of people in urban areas. These infrastructures require high levels of finance; thus, given the budgetary constraints in the public sector, the need for private sector participation is increasing. Furthermore, competition is growing, mainly in projects that have already been built and are mature (brownfield), where the presence of infrastructure and pension fund management companies is growing.

MAIN ASSETS

Cintra holds 43.23% of the 407 ETR toll road in Toronto (Canada) and the NTE and LBJ managed lanes toll roads in Texas (USA), where it has a stake of 56.7% and 51% respectively. The above assets operate as free-flow tolls (without barriers) and are notable for their long duration and broad tariff flexibility. In the managed lanes, toll rates are dynamic: they change according to the average speed or number of vehicles that use them, guaranteeing a minimum speed for drivers.

VALUE CREATION

Risk reduction or “de-risking”

The price of a concession is determined by a number of factors, including the internal rate of return (IRR) at which it is tendered, which is the result of adding a risk premium to the risk-free rate that takes into account the risks assumed by shareholders when they invest in the concession (mainly construction, finance, operation and traffic). Cintra aims to reduce or eliminate these risks as the concession operation progresses, limiting the premium required by the market over the valuation of the assets, which in turn increases their value. This value creation process does not require any improvement over the forecast volumes, but compliance with the initial estimates.

For example, the NTE and LBJ toll roads in Texas (USA), which began operating in 2014 and 2015, respectively, have already eliminated all construction risk. In their initial years of operation (two years in NTE and one year in LBJ), both concessions achieved the original forecast revenues, and although both are still in the ramp-up period, a significant part of operating risks have been reduced.

Operational and financial efficiencies

Cintra aims to maximize operating cash flows by efficient management and innovation, incorporating the most advanced technology possible and the search for synergies with the company’s other highways, while always guaranteeing user satisfaction and responding to their needs. Cintra also aims to find sources of finance for its projects that optimize cash shareholder return, while adapting as far as possible to the generation of project cash flows.

In order to maximize operating cash flows, Cintra began to use Big Data techniques in 2016 to understand driver behavior better, with a twin goal:

- Improve the reliability of traffic estimates and new project revenues. for example, the traffic study on managed lanes on the I-66 toll road used congestion data and travel patterns collected in the corridor through GPS. This provided information on congestion and the movement of users which was more detailed and reliable than the result generated in previous projects. It allowed connectivity to be improved, thus increasing use of the highway.

- Maximize revenues from projects underway: to optimize its toll charge policy, the 407 ETR toll road incorporates Big Data from drivers on the 407 ETR itself and those on the alternative competing highway.

As an example of efficient finance, in 2016 Cintra refinanced the toll road in Ausol (Spain) with a new issue of over 500 M€, at 30 years and a yield of 3.75%. This will substantially reduce the future financial burden of the project, and increase cash flows for shareholders.

Contract renegotiation

In the long life of concession and finance agreements, it is normal for modifications to be renegotiated as a result of the changing needs of the public authorities, variations in the characteristics of the corridors where the infrastructure is built, or the situation of the financial markets. In these cases, Cintra proposes solutions to the public authorities or financial institutions that resolve its problems and improve the risk profile of the asset and/or cash flow generation for shareholders.

High-complexity greenfield projects

Cintra’s primary focus is on complex greenfield projects, given their high potential to create value and the level of competitiveness generated by the accumulated experience of Cintra and Ferrovial Agroman, which for 45 years has led the sector of cutting-edge technological solutions in innovative projects.

Cintra’s collaboration with Ferrovial Agroman in tenders generates two additional competitive advantages: first, the experience and value of the construction company’s Technical Office makes it possible to optimize design and thus improve prices for clients while maintaining profitability in line with the project risks; and second, as both businesses are part of Ferrovial, they are aligned in seeking the solution that maximizes the value of the asset, while optimizing the initial investment mix and future operating and maintenance costs, as well as increasing revenue collection. The need for public-sector funds is therefore minimized and new financial investors are attracted.

An example of this is the recent award of the I-66 highway section in Virginia (USA), a managed lanes project with a high level of technical complexity and concession value, investment of over 3 B US$ and a concession period of 50 years. In its bid, Cintra presented various improvements to the design, which eliminated the need for public funds. As a result, it won the bid.

Rotation of mature assets

After reducing risks, the value created is crystallized by the sale of mature projects to other investors, channeling the proceeds to investment in new assets that have a greater potential profitability (higher risk premium).

In 2016 Cintra reached an agreement with the Dutch infrastructure fund management company DIF for the transfer of 46% of the M4 and 75% of the M3 toll roads in Ireland for 59 M€. Cintra now holds a 20% stake in each concession, and remains a key industrial partner.

Society: socially responsible infrastructures

Due to its high complexity, innovation and efficiency, the projects developed by Cintra offer sustainable solutions that improve congestion in big cities, reduce pollution, decrease the number of accidents, increase user satisfaction and, ultimately, contribute substantially to improve the quality of life of people in the communities where the assets are located.

Users: customized service

The service it provides for users is a priority for Cintra, which employs the new technologies available to develop and explore new channels of communication between clients and the company.

Employees: internal mobility and support for merit

Cintra aims to provide opportunities for the professional development of all its employees, promoting internal mobility (both functional and geographic) and ensuring that merit is a determining factor in the professional career of each person. Internal mobility is reflected in the fact that in 2016, 19% of the structural personnel have had the opportunity to change their position, with 26% currently working abroad, and 35% received and international post.

NTE-LBJ Managed Lanes Highways

In Dallas, Texas, Ferrovial had to deal successfully with the enormous engineering challenge of creating new roads in one of the busiest and fastest-growing areas in the country, while keeping traffic flowing. With their dynamic traffic management, managed lanes have improved conditions for users of these highways and the corridor: congestion times per day have fallen by over 60%, average speed has increased by 10-15%, CO2 emissions have reduced significantly and driver safety has improved.

New user management tools

New tools have been developed to improve the service for users, such as TEXpress Lanes Care on the NTE and LBJ toll roads, to register, manage and respond to all the communications received by users. Also, the Satelise app in Autema (Spain) for payment using GPS technology via smartphone, means that drivers do not need to stop for payment. The app is planned for implementation in other highways.