Corporate Governance

Ferrovial's corporate governance seeks to guarantee integrity, which is construed as ethical, transparent and responsible conduct towards shareholders, employees and the different agents affected by the company's activities. This principle is key to ensuring profitable business and long-term sustainability in line with the company's strategy while strengthening the trust that shareholders and the different stakeholders have in the company.

In compliance with commercial law, the Annual Corporate Governance Report (ACGR) forms part of this management report, which was drawn up by the Board of Directors and filed with the Spanish Securities Commission. The ACGR details all corporate governance aspects at Ferrovial and is available at www.ferrovial.com.

Notwithstanding the foregoing, the most prominent elements of corporate governance at Ferrovial is summarized below.

ETHICS AND TRANSPARENCY

The following developments in 2016 for the area of good governance are particularly noteworthy:

- Update by the Board of Directors of the Ferrovial compliance model:

- Approval of a new Compliance Policy.

- Update of the Anti-Corruption Policy.

- Revision of the Crime Prevention Model with a view to adapting its content to the regulations regarding the criminal liability of legal entities as contemplated in the Spanish Penal Code.

- Amendment of the Risk Control and Management Policy to include the content of recommendations 43 and 44 of the Code of Good Governance for listed companies.

- Amendment by the Board of Directors of the Internal Regulations for Conduct in the Securities Markets with a view to adapting its content to Regulation (EU) No 596/2014 on market abuse and the implementing provisions thereof*.

- Approval by the Board of Directors of the Policy regarding communication and contacts with shareholders, investors, proxy advisers and credit rating agencies* with a view to comply with recommendation 4 of the Code of Good Governance for listed companies.

- Approval of a corporate procedure regarding representation expenses.

- Approval of a corporate procedure for hiring people and companies linked to employees.

- Update of the corporate procedures regarding the complaints box.

- Modification of the internal procedure for commissioning external auditors and other jobs with external auditors to adapt the wording to the new Spanish Audit Act.

- Amendment of the contracts with the Executive Directors of the company to include a clawback clause regarding their variable remuneration for cases in which their payment was made on the basis of data that are partially or entirely inaccurate.

- Publication on the website for the session of the Annual General Meeting, of a report on the independence of the auditor drawn up by the Audit and Control Committee, thus fulfilling article 21 II f) of the Board of Directors Regulations (recommendation 6.a) under the Code of Good Governance for listed companies.

CODE OF BUSINESS ETHICS

Ferrovial’s Code of Business Ethics* was last updated in 2014 and applies to all group companies, directors, employees and managers as they go about their duties, and which includes a specific commitment to compliance with certain applicable laws. The following are among the included areas:

- Relations with the public sector: Ferrovial is committed to maintaining open and honest communications in its rapport with public sector agents.

- Anti-corruption Laws: the company requires compliance of all applicable laws prohibiting bribery or any other form of corruption. This is bolstered by the new Anti-Corruption Policy approved by the company in 2014 and subsequently updated in 2016.

- Use of privileged information: those possessing nonpublic and specific information that, should it become public, could have a significant effect on the price of the securities of Ferrovial (or another issuing company to which said privileged information may refer), must strictly adhere to the pertinent legislation in force and, in particular, may not: attempt to execute or execute any sort of transaction involving said instruments on his/ her own behalf or on the behalf of a third party, whether directly or indirectly; recommend, mislead or induce third parties to execute such transactions; disclose said information to third parties unless within the normal course of business, profession or duties.

- Anti-money laundering laws: employees must comply with all legislation against money laundering, doing business with partners who have good reputations and receive funds only from legitimate sources.

- Fair competition: Ferrovial proscribes any action that could entail unfair competition practices and thus undertakes to ensure compliance with the competition laws applicable in the countries where it operates. In 2014, Ferrovial’s Board of Directors approved a Corporate Competition Policy.

- Accurate accounts and records: Ferrovial subsidiaries across the world must implement accounting practices that ensure accurate accounts and record keeping. Since 2015, Ferrovial has had a software-based organizational procedure in place for guaranteeing the reliability of financial information and monitoring its efficient functioning.

WHISTLEBLOWING CHANNEL

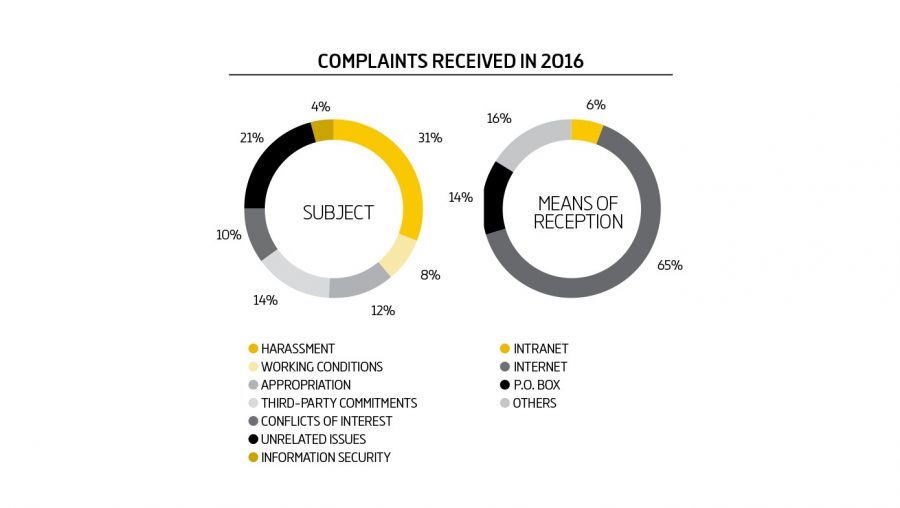

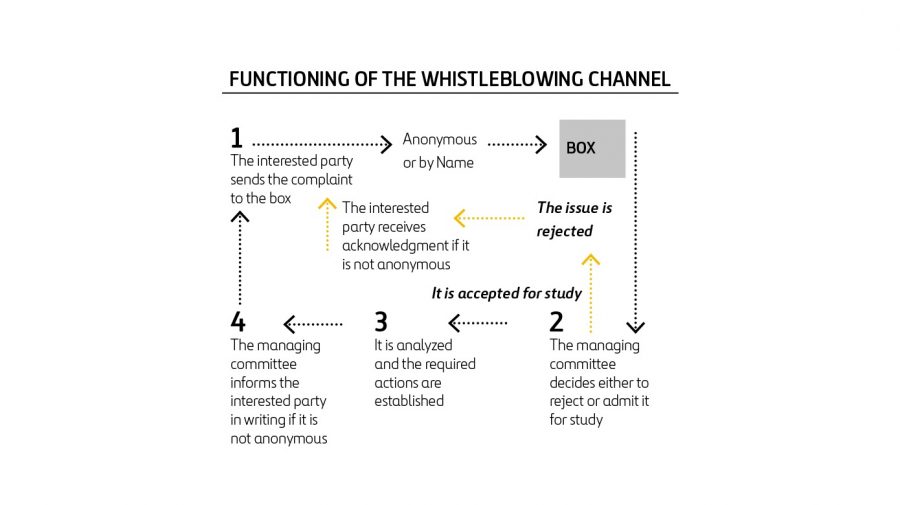

Ferrovial’s Whistleblowing Channel was set up in 2009 to complement other internal channels and ensure compliance with the Code of Business Ethics, internal procedures and protocols by enabling the whistleblowing of irregularities, non-compliance and any unethical or illegal conduct. The channel may be used by the public via the website and enables communications in full confidentiality, whether submitted anonymously or by name.

A postbox was also set up to make such communications. In 2016 a total of 51 complaints were filed, 23 of which were anonymous and 28 made by name.

All complaints are investigated by the Complaints Box Managing Committee, which includes the Director of Internal Audits and the General Director of Human Resources. The Committee meets regularly, except when a report warranting immediate attention is received.

Ferrovial also has a corporate procedure in place to protect the company’s business assets and prevent fraud. This document was updated in 2012 to prevent any illegal conduct that might harm the company.

CORPORATE GOVERNANCE: NEWS

- Amendment of company Bylaws to, inter alias, adapt the content thereof to the changes in the Spanish Corporate Enterprises Act in light of the new Spanish Audit Act.

- Total or partial compliance with the majority (56 of 59) of applicable recommendations under the Code of Good Governance for listed companies.

- Appointment of Philip Bowman as Independent Director.

- Drawing up by the Appointments and Remunerations Committee, and posting on the website, for the recent session of the Annual General Meeting, of a report on the needs of the Board of Directors insofar as its composition.*

- Further corporate policies were also approved in 2016, including:

- Remuneration policy for directors*, approval by the Annual General Meeting.

- Remuneration policy for senior management.

- Treasury Share Policy, included in the Internal Regulations for Conduct in the Securities Markets*, to incorporate the criteria that the Spanish Securities Commission (CNMV) recommends that issuing firms observe in their discretionary treasury share operations.

GOVERNING BODIES

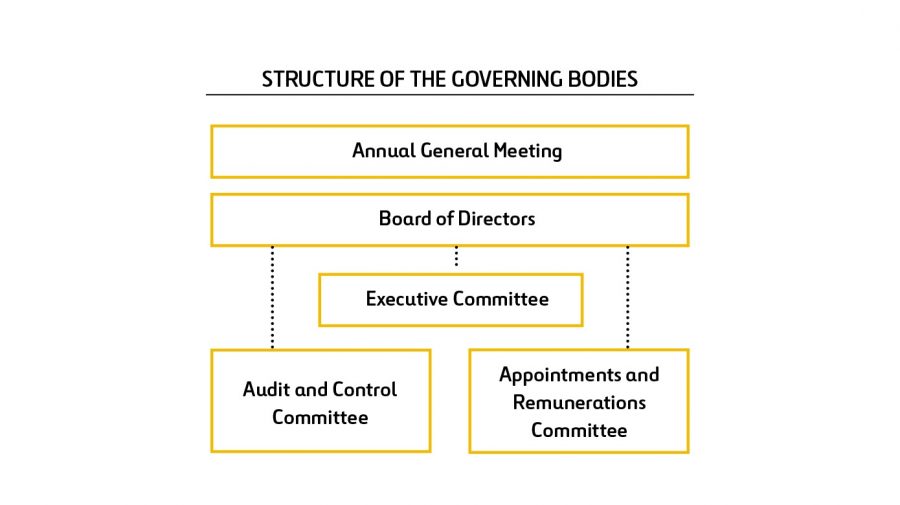

The ACGR details how the company’s management bodies and the decision-making process work, with emphasis on the roles of the Annual General Meetings and Board of Directors as the company’s most senior management bodies.

Ferrovial observes the standards and principles of domestic and international best practices in relation to good governance, as adapted to the company’s nature, structure and evolution.

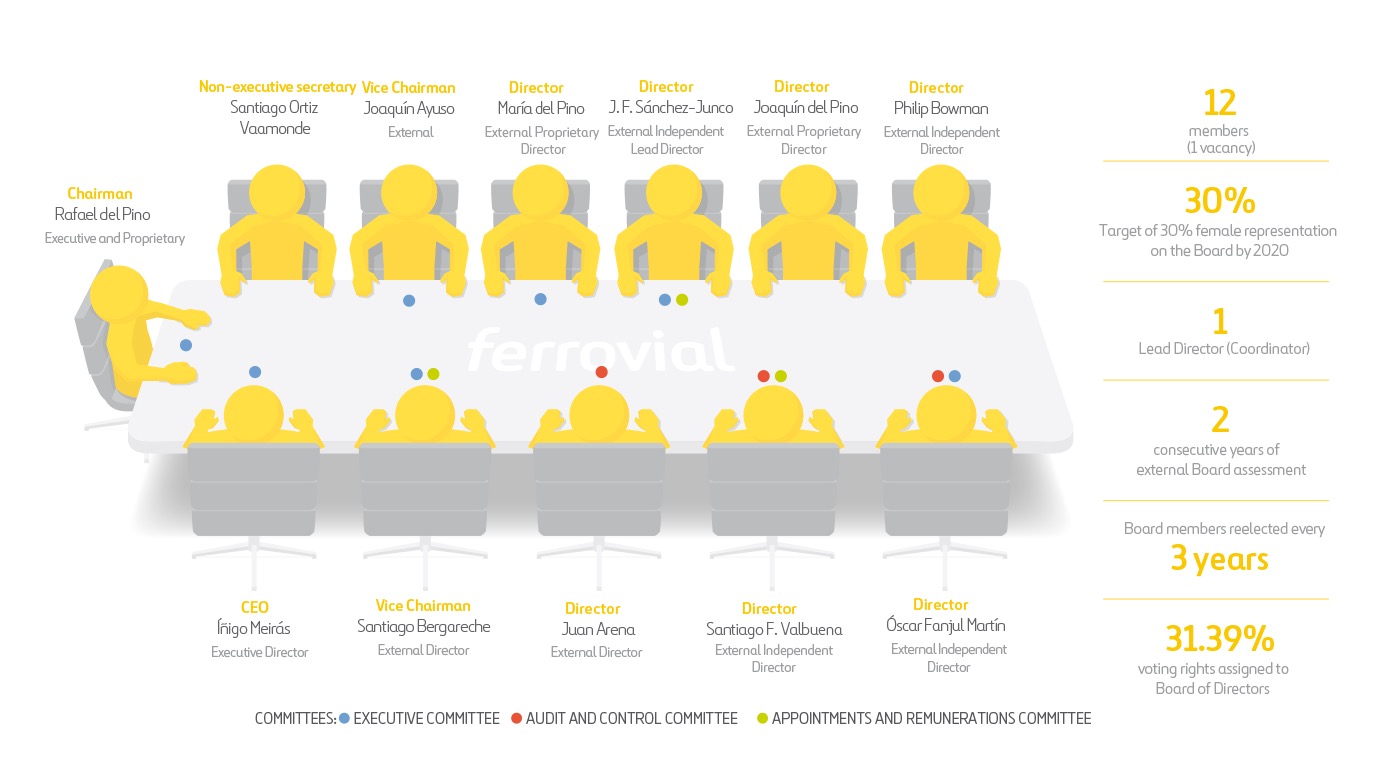

Board of Directors

The Board performs its duties with unity of purpose and independent judgment. It treats all shareholders in the same position equally, and works in the social interest, with the same understood to mean securing a profitable business that is sustainable in the long term, supporting its continuity and seeking optimal economic value for the company. A total of 8 sessions were held in 2016 with an average duration of 5 hours and 20 minutes per meeting and an attendance of 98.82%.

Items addressed by the Board of Directors in 2016

Every year and whenever requested by its Chairman, the Board of Directors draws up a program of dates and matters to address at each of the scheduled sessions for the following year, notwithstanding additional matters that could arise throughout the year. The main matters addressed at the Board meetings in 2016 are detailed below.

Executive Committee

This body has all delegated powers corresponding to the Board of Directors, except for powers that cannot be delegated for legal or statutory reasons.

The committee comprises seven members. In addition to other matters, it monitors the performance of key business indicators and operations underway at Ferrovial.

Appointments and Remunerations Committee

The Committee comprises three Non-Executive Directors, the majority of whom are independent, including the Chairman.

Their main duties, other than those attributed by law, are described below, representing the adoption of recommendations under the code of good governance for listed companies:

- Proposing basic terms for senior management contracts.

- Ensuring that all non-executive directors have sufficient time to duly perform their duties.

- Ensuring compliance with the remuneration policy established by the company.

- Verifying information on remunerations for directors and senior management contained in the various corporate documents, including the Annual Board of Directors’ Remuneration Report.

- Ensuring that any conflicts of interest do not impair the independence of the advice provided to the Committee.

The activities that the Committee carried out during the five sessions held in 2016 are detailed in the report regarding its operation*.

Audit and Control Committee

The Committee comprises three Non-Executive Directors, the majority of whom are independent, including the Chairman. All of them were appointed in consideration of their knowledge and experience in accounting, auditing or risk management.

Their main duties, other than those attributed by law, are described below, representing the adoption of recommendations under the code of good governance for listed companies:

- Supervising the generation and presentation of mandatory financial information, and ensuring that the Board seeks to present accounts to the Annual General Meeting without any limitations or qualifications in the audit report.

- Supervising effectiveness of the internal financial information control system.

- Ensuring that the company and the accounts auditor adhere to rules governing the provision of services other than auditing, limits on the concentration of auditor services and other general regulations concerning the independence of account auditors.

- Ensure that the remuneration of the auditor of accounts does not compromise quality or independence.

- Receiving regular information on activities from the Internal Audit Department.

- Ensuring the independence of the Internal Audit Department.

- Establishing and supervising a system that allows employees to confidentially and, if possible and deemed appropriate, anonymously report any irregularities with potentially serious implications that may be identified at Ferrovial, particularly regarding financial and accounting matters.

- Supervising compliance with internal corporate governance and conduct standards for securities markets, and proposing improvements.

- Coordinating the process for reporting non-financial information according to the applicable legislation and benchmark international standards.

The activities that the Committee carried out during the five sessions held in 2016 are detailed in the report regarding its operation*.

* Available at the website www.ferrovial.com

Main items addressed by the Board of Directors in 2016

- Drawing up of the financial statements.

- Announcement for the Annual General Meeting.

- Approval of operations.

- Report on fiscal policies followed by the company during 2016.

- Report from each business division and corporate area.

- Annual assessment of the Board and its Committees.

- Regular Health and Safety reports.

- Corporate social responsibility Report.

- Quality and Environmental Report.

- Reports on competence, analysts and shareholders of Ferrovial.

- Annual budget and amendments to the budget for the current year.

- Scrip dividend.

- Board member remuneration.